Trading Fees

Interactive Brokers offers highly competitive fees tailored to different account types:

- IBKR Lite: Free trades for U.S. stocks and ETFs.

- IBKR Pro: $0.005 per share with a $1 minimum and a 1% maximum of trade value. Volume discounts are available for active traders.

This dual structure caters to both casual and professional investors, offering flexibility and value.

Platform Details

- Supported Platforms: Web, Mobile, and Desktop (IB Trader Workstation).

- Assets: Stocks, ETFs, bonds, mutual funds, options, futures, forex, metals, and cryptocurrencies.

- Supported Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH).

- Customer Service: 24/7 live chat, phone, and email.

- Education Resources: Comprehensive materials through Traders Academy Online.

Pros:

- Low fees and competitive margin rates.

- Feature-rich trading platform with advanced tools.

- Extensive range of assets, including international markets.

- Reliable trade execution and deep research tools.

Cons:

- Platforms can be overwhelming for beginners.

- Complex tiered pricing structure for IBKR Pro.

About Interactive Brokers

Founded in 1977 by Thomas Peterffy, Interactive Brokers has grown into a global leader in electronic trading. With headquarters in Greenwich, Connecticut, the firm operates across 33 countries and supports a wide variety of asset classes. As a publicly traded company on NASDAQ, Interactive Brokers offers transparency and trust, managing over $170 billion in client equity.

Interactive Brokers caters to both seasoned professionals and newer traders through its IBKR Pro and IBKR Lite offerings. It combines powerful tools, low costs, and access to global markets, making it a preferred broker for serious investors.

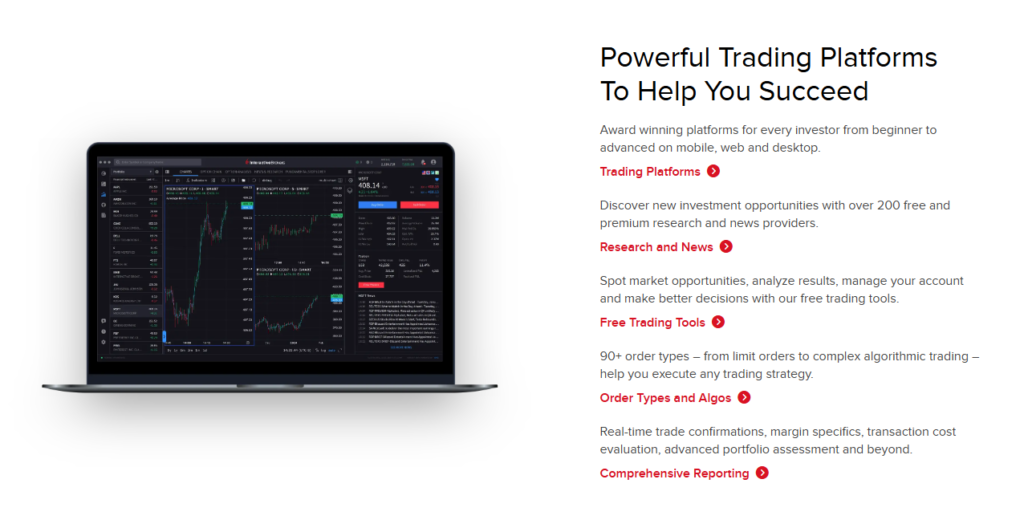

Features and Tools

1. Advanced Trading Options

The IB Trader Workstation (TWS) is the platform’s centerpiece, designed for experienced traders. It includes:

- Tools like the Options Strategy Lab, Volatility Lab, and Portfolio Builder.

- Market scanners and dynamic watchlists.

- Access to real-time data from sources like Reuters and Morningstar.

For beginners or those seeking simplicity, the Client Portal provides a streamlined interface for basic trading and portfolio management.

2. Mobile App (IBKR Mobile)

Available on iOS and Android, the mobile app offers:

- Real-time data and charting tools.

- Access to all major asset classes.

- IBot AI assistant for quick trade execution and answers to queries.

3. Cryptocurrency Trading

Interactive Brokers partners with Paxos Trust to offer 24/7 trading in Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. With 0.12%-0.18% transaction fees (based on volume), it’s one of the more affordable platforms for crypto trading.

4. Research and Education

Interactive Brokers provides:

- Market data and reports from trusted sources.

- Customizable research tools and charts.

- Educational materials via Traders Academy Online for all levels of investors.

Fees and Commissions

IBKR Lite Fees:

- Free trades on U.S. stocks and ETFs.

IBKR Pro Fees:

- Fixed Pricing: $0.005 per share ($1 minimum, 1% max).

- Tiered Pricing: Starts at $0.0035 per share for under 300,000 shares, decreasing with volume.

Crypto Fees:

0.12%-0.18% per transaction value, with no spreads or hidden costs.

Additional Fees:

- ACH deposits: Free.

- Wire transfers: $10 deposit, $25 withdrawal.

- Margin trading: Industry-leading low rates.

Supported Assets

Interactive Brokers supports a diverse range of assets, including:

- Stocks, ETFs, mutual funds, bonds, options, futures, and forex.

- Precious metals and over 4 cryptocurrencies.

- International market access across 33 countries, making it a leader in global trading.

Is Interactive Brokers Safe?

Interactive Brokers is highly secure, with licenses from top regulatory bodies and a long-standing reputation for trustworthiness:

- A+ BBB rating for reliability.

- Insurance Coverage: Client funds are insured against potential risks.

- Security Features: Two-factor authentication and advanced encryption.

With over 1 million active accounts, Interactive Brokers has earned its place as one of the safest brokers in the industry.

How to Open an Account

Interactive Brokers makes it easy to get started:

- Start Application: Provide basic details (email, username, password).

- Verify Identity: Submit ID and proof of residence.

- Choose Account Type: Select between Cash, Margin, or Portfolio Margin accounts.

- Fund Your Account: No minimum deposit required for cash accounts; $2,000 for margin accounts.

Once verified, you can begin trading across all supported markets.

Conclusion

Interactive Brokers is a top-tier brokerage catering to both professionals and casual investors. With IBKR Lite, newcomers can enjoy commission-free trades, while IBKR Pro provides advanced tools and low-cost trading for experienced users. The platform’s broad range of assets, low fees, and global market access set it apart in the brokerage industry.

However, beginners may find the advanced tools overwhelming. Despite this, the extensive educational resources and user-friendly mobile platform make it a versatile choice for traders at all levels. Whether you’re looking to trade crypto, stocks, or international markets, Interactive Brokers offers one of the most comprehensive trading environments available.