Trading Fees

eToro charges a 1% fee for buying or selling cryptocurrencies. For stocks and ETFs, the platform absorbs regulatory transaction fees, ensuring no additional costs for traders. However, there is a $5 withdrawal fee for any withdrawal request.

Account Fees

eToro applies a $75 fee for both partial and complete account transfers. This can be a drawback for traders planning to transfer their portfolios to another broker.

Supported Assets and Cryptocurrencies

- Stocks, ETFs, Indices, Commodities, Currencies, and Cryptocurrencies

- Supported cryptocurrencies: 78, including Bitcoin (BTC), Ethereum (ETH), and Dogecoin.

Platform Detail

- Supported Platforms: Available on Web and Mobile for convenient access.

- Broker Type: Offers trading across stocks, crypto, indices, ETFs, commodities, and forex.

- Education Resources: Comprehensive learning materials for beginner and advanced traders.

- Customer Service: 24/7 support via phone, chat, and email.

Pros:

- Wide range of crypto assets (78 cryptocurrencies supported).

- User-friendly interface suitable for beginners.

- Innovative CopyTrader feature for social trading.

- Rich educational resources for learning and improving trading skills.

Cons:

- Not available in every U.S. state.

- Relatively high fees for certain services.

About eToro

Founded in 2007, eToro provides access to a wide range of financial instruments, from equities and ETFs to cryptocurrencies. The brokerage is regulated by FINRA, SIPC, and the SEC in the U.S., ensuring a secure and compliant trading environment. This legitimacy is further reinforced by its membership in established regulatory organizations.

The platform has grown over the years, introducing innovative features like CopyTrader in 2010 and expanding its offerings to include cryptocurrencies in 2013. eToro is ideal for beginner traders who want an intuitive trading experience backed by robust tools and social features.

Platform Features

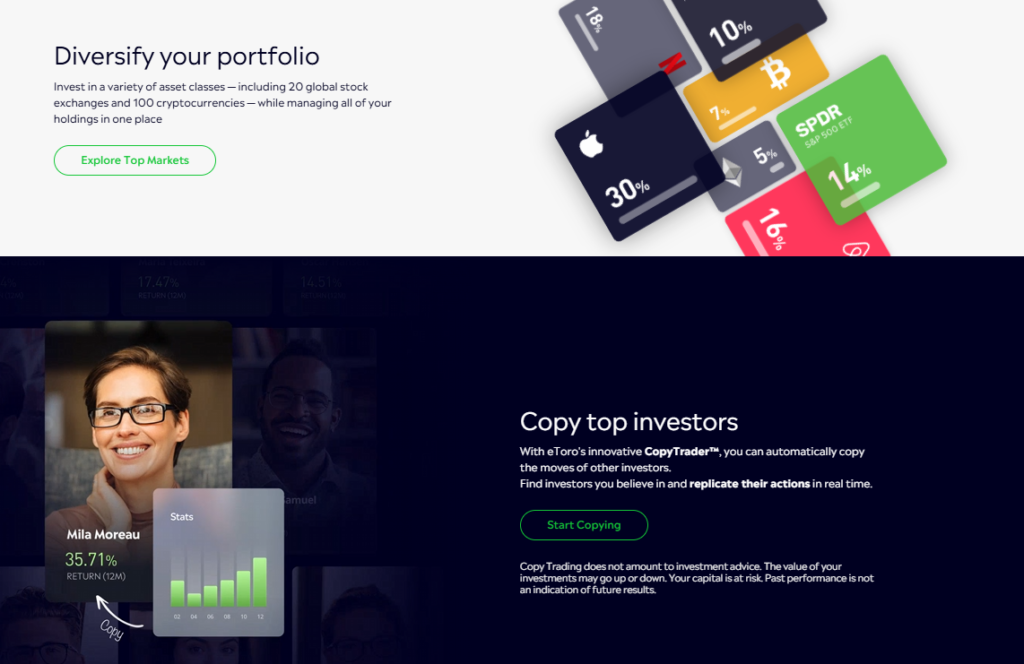

Social Trading

eToro’s standout feature is CopyTrader, which allows users to mimic the trades of successful investors on the platform. Popular Investors, those whose trades are copied frequently, are directly compensated by eToro.

SmartPortfolios

These portfolios are managed by eToro, allowing users to invest in diversified, pre-constructed portfolios. This feature provides an automated approach to investing without additional management fees.

Fractional Shares

Investors can purchase fractional shares of stocks, making it accessible to those with smaller capital.

Mobile App

The platform offers the eToro Cryptocurrency Trading app and the eToro Money wallet for mobile users. These apps allow seamless trading and management of cryptocurrencies on the go.

Ease of Use

eToro is designed with simplicity in mind, making it beginner-friendly. The interface is clean and intuitive, allowing new traders to learn quickly. The inclusion of social trading tools like feeds and CopyTrader makes it easy to engage with the community and develop strategies.

Fees and Commissions

- Crypto Fees: eToro charges a 1% spread, which is applied at the time of purchase and sale.

- Stock and ETF Fees: Zero commission on trades; regulatory fees are absorbed by eToro.

- Minimum Deposit: $50.

- Withdrawal Fee: $5.

- Minimum Crypto Purchase Order: $20.

eToro does not offer margin trading for cryptocurrencies, and the trading fee is relatively higher than some dedicated crypto exchanges.

Supported Cryptocurrencies

eToro supports 78 cryptocurrencies, including popular options like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin

- Litecoin (LTC)

- XRP (Ripple)

This extensive list makes it a strong choice for cryptocurrency traders.

How to Open an Account

- Create an Account: Visit eToro’s website and register with your name, email, and password or connect via Google/Facebook.

- Verify Your Email: Confirm your email address.

- Complete Your Profile: Provide basic personal details, investment experience, and upload identity documents.

- Verify Identity: Submit valid proof of identity and proof of address, ensuring clear images of all documents.

- Deposit Funds: Log in, select “Deposit Funds,” enter the amount, and choose your payment method.

- Start Trading: Once verified, explore the platform and begin trading.

Is eToro Safe?

eToro is regulated by multiple authorities, including FINRA, SIPC, and the FCA (UK). U.S. investors’ cash deposits are insured by the FDIC up to $250,000. However, eToro does not offer third-party insurance for digital assets, which some competitors provide.

Conclusion

eToro is a versatile platform that combines traditional asset trading with extensive cryptocurrency offerings. Its CopyTrader and SmartPortfolio features make it ideal for beginners seeking guidance, while its wide asset selection appeals to seasoned investors.

With competitive spreads, 78 supported cryptocurrencies, and strong regulatory backing, eToro stands out as a reliable choice for social trading and portfolio diversification. However, users should be mindful of its relatively high fees and limited availability in some U.S. states.